Multilateral adaptation finance for systemic resilience: addressing transboundary climate risk

Introduction

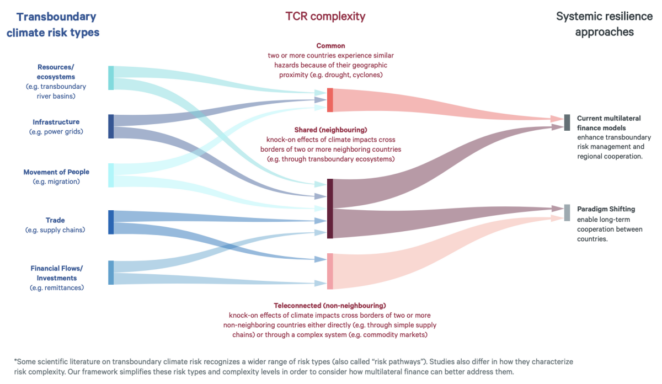

Research increasingly highlights transboundary climate risks (Carter et al. 2021; Challinor et al. 2018). Most recently, the IPCC’s Working Group II report warned that climate change impacts and risks were becoming increasingly complex and more difficult to manage, and that climatic and non-climatic risks would interact and result in risks cascading across sectors and regions. But multilateral adaptation finance continues to treat climate risk largely as a local phenomenon, focusing on enabling adaptation at local scales.

This study used SEI’s Aid Atlas platform to analyze adaptation projects funded by three major multilateral climate funds: the Green Climate Fund (GCF) and the Adaptation Fund (AF) under the UN Climate Convention, and the Climate Investment Funds (CIFs) under the World Bank. The authors examined the extent to which these funds support projects addressing climate risks in more than one country, identifying regional and multi-country adaptation projects approved between 2010 and 2020.

This article is an abridged version of the original text, which can be downloaded from the right-hand column. Please access the original text for more detail, research purposes, full references, or to quote text.

Key Findings

- The study found that most funding is directed to countries on an individual basis for specific national or local projects. The GCF and CIFs committed only a small percentage of overall funding to regional projects. The AF committed about a quarter of all funding.

- Based on the analysis of project objectives and descriptions, we found that most regional projects address common risks – for example drought in the Niger Basin and cyclones in the Caribbean – rather than risks that cross national borders.

- Smaller countries, or those with perceived lower capacity, were grouped with larger countries or higher capacity countries (often neighbouring) to enable efficient project management. In all projects, the countries involved were clustered by geography (i.e. sharing geographical borders or part of the same geographical region).

- The Adaptation Fund is an important exception among the three funds. In addition to directing a higher percentage of its overall funding to regional projects, it has also supported five projects which explicitly frame risk as transboundary.

- Despite recognizing transboundary climate risks, none of the five projects bring together non-neighbouring countries. Thus, none of the funds analyzed supported projects that address teleconnected climate risks.

Explore the key findings in more detail on pages 2-3 of the brief.

Operationalising systemic resilience in adaptation finance

The way that three major multilateral funds supporting adaptation frame risks in their project portfolios indicates a disconnect from the scientifically established recognition of transboundary climate risks. Multilateral adaptation finance can and should do more to address these risks. In an interconnected world, investments in systemic resilience would deliver shared benefits for both recipients and contributors. Systemic resilience here refers to interventions that seek to enhance the resilient performance of a whole system, rather than individual countries or nodes in that system.

The authors foresee two ways to operationalize systemic resilience in adaptation finance:

- Current funding models can effectively address certain types of transboundary climate risk, at lower levels of complexity. These include risks common to neighbouring countries, as well as shared risks to resources, ecosystems and infrastructure. They can also enhance local resilience to transboundary climate risks, for example by building food security resilience to help vulnerable communities withstand market shocks.

- Other types of transboundary climate risks, including those that are more complex (i.e. teleconnected risks), will require established actors to adopt paradigmshifting approaches, and to involve actors new to adaptation finance.

Case studies:

- Shared climate risk along the Blue Nile River – this is a case where shared resources cross the borders of neighbouring states (Lager et al., 2021).

- The Blue Nile originates in Ethiopia, flows through Sudan, and merges with the White Nile to enter the sea via Egypt.

- Management of the river – which contributes 70% of the Nile’s flow – has historically been a source of conflict among the three countries.

- A systemic resilience approach that accounts for transboundary climate risks, such as water scarcity and disruptions to electricity generation due to drought, could focus on regional collaboration to improve irrigation efficiency and help to defuse tensions between countries.

- Teleconnected risks in volatile rice markets – this is a case of more complex transboundary climate risks.

- Many highly vulnerable countries depend on imported food. Climate impacts in rice-exporting countries such as India, Thailand, and Vietnam are often felt most acutely in countries that rely on rice imports, such as the Philippines, Bangladesh, and Benin.

- Current approaches to improving resilience focus primarily on increasing agricultural productivity in importing countries. A systemic resilience approach could support investments in strategic grain storage.

Learn more about these 2 approaches, and their respective case studies, on pages 3-4 of the brief.

Tackling transboundary climate risks: opportunities and limitations

Current funding models have significant limitations:

- The project-based approach, in which funds support specific interventions on five to seven-year timeframes, inhibits many long-term, systemic investments.

- The country-level approach – in which funds designate a single national government as primary project administrator – limits shared ownership of multi-country projects.

- Some eligibility requirements prevent investments in wealthier countries that could benefit lower-income counterparts.

- Finally, projects that address transboundary climate risks would continue to face the broader challenges of climate finance in general.

Funding guidelines, however, offer some opportunities to rethink approaches and scaleup support for projects that address transboundary climate risks including those that link non-neighbouring countries. The AF’s guidelines stand out, because they explicitly allow for projects at the “regional and transboundary level,” providing the clearest avenue to focus on transboundary climate risks among the three funds.

Efforts to build systemic resilience face even more significant barriers. Such a fundamental alteration of multilateral climate finance would challenge vested interests motivated to uphold the status quo. Yet there are incentives for contributors, recipients, and new multilateral actors to develop systemic resilience approaches. Both contributing and recipient countries recognize that the current climate finance system, especially public finance channeled through the UN, is too fragmented and small-scale to address growing risks.

Explore the barriers and opportunities in more detail on pages 5-6.

Related resources

- Just transition for climate adaptation: A business brief

- How can we fund adaptation efforts to address cascading climate risks in the Hindu Kush Himalaya and other mountain regions?

- Climate adaptation must be reframed from a local issue to a global responsibility

- Questioning the scientific feasibility and policy relevance of assessing transboundary climate risks

(0) Comments

There is no content